- Individuals and families earning

less than $75,000 annually - Non-English speaking taxpayers

- Individuals with disabilities

- Seniors aged 60 and older

QUESTIONS?

Please call: 843-321-9071 or email:

vitalowcountrysc@gmail.com

ONLINE TAX PREP OPTIONS

Virtual Assistance:

Email virtualvitalc@gmail.com

Do It Yourself:

Visit www.myfreetaxes.com

HELPFUL RESOURCES

(Available in English and Spanish)

Volunteer Income Tax Assistance (VITA) Free Tax Preparation

Starting January 12, 2026, you can schedule an online appointment for tax preparation at our VITA locations. All sites are officially closed until the first week in February with scheduled appointments and/or walk-ins. This year, VITA services are available across Bamberg, Barnwell, Beaufort, Colleton, and Jasper counties, offering you convenient access to professional assistance.

2026 VITA Sites

Virtual Site

Online Virtual Assistance

[Click Here to Schedule Appointment]

Beaufort County

City of Beaufort Area

Beaufort Library

311 Scott St., Beaufort, SC

Tuesdays and Thursdays: 10 AM to 4 PM

Open: February 3 to April 14

[Click Here to Schedule Appointment]

Lobeco Library

1862 Trask Pkwy., Seabrook, SC

Saturdays: 11 AM to 3 PM

Open: February 7 to April 11

[Click Here to Schedule Appointment]

Port Royal Library

1408 Paris Ave., Port Royal, SC

Mondays: 11 AM to 3 PM

Open: February 2 to April 13

Closed: February 16

[Click Here to Schedule Appointment]

St. Helena Library

6355 Jonathan Francis Sr. Rd., St. Helena Island, SC

Wednesdays: 11:30 AM to 5:30 PM

Open: February 4 to April 8

[Click Here to Schedule Appointment]

Bluffton/Hilton Head Island

Bluffton Library

120 Palmetto Way, Bluffton, SC

Mondays: 10 AM to 4 PM

Saturdays: 10 AM to 3 PM (appointment only)

Saturday dates: February 28, March 14,

March 21, April 4, April 11

Open: February 2 to April 13

Closed: February 16

[Click Here to Schedule Appointment]

Hilton Head Library

11 Beach City Rd., Hilton Head Island, SC

Thursdays: 11 AM to 3 PM

Open: February 5 to April 9

[Click Here to Schedule Appointment]

The Deep Well Project

80 Capital Dr., Hilton Head Island, SC

Tuesdays and Thursdays: 5:15 PM to 7:15 PM

Drop-offs welcome

Open: February 17 to April 9

[Click Here to Schedule Appointment]

VIM Clinic Hilton Head Island

15 Northridge Dr., Hilton Head Island, SC

Wednesdays: 1 PM to 4 PM

Open: February 4 to April 8

[Click Here to Schedule Appointment]

Jasper County

AGAPE Family Life Center

5855 S Okatie Hwy., Hardeeville, SC

Mondays: 3 PM to 6 PM

Saturdays: 9 AM to 12 PM

Open: February 2 to April 13

Closed: February 16

[Click Here to Schedule Appointment]

Hardeeville Library

30 Main St., Hardeeville, SC

Tuesdays: 11 AM to 4 PM

Open: February 3 to April 14

[Click Here to Schedule Appointment]

Palmetto Electric Cooperative NEW!

4063 Grays Hwy., Ridgeland, SC

Mondays: 10 AM to 3 PM

Open: February 2 to April 13

Closed: February 23 and March 23

[Click Here to Schedule Appointment]

Barnwell County

Community Uplifting Alliance Project

5983 Lartigue St., Blackville, SC 29817

Tuesdays: 5:30 PM – 7 PM (Appointments Only)

Fridays: 10 AM – 3 PM (Walk-ins Only)

Saturdays: 10 AM – 2 PM (Appointments Only)

Open: February 3 – April 14

Call: 803-284-0735

[Click Here to Schedule Appointment]

Bamberg County

Voorhees University, St. James Building

1897 Voorhees Rd., Denmark, SC 29042

Thursdays, 5 PM – 7 PM

(Appointments and Walk-ins Available)

Open: February 5 – April 9

Closed: March 5

[Click Here to Schedule Appointment]

Colleton County

Lowcountry Community Action Agency

1605 N. Jeffries Hwy., Walterboro, SC

Tuesdays and Thursdays: 10 AM – 3 PM

Appointment only

Open: February 3 – April 14

Call: 843-549-5576

Closed: February 10 & 12

[Click Here to Schedule Appointment]

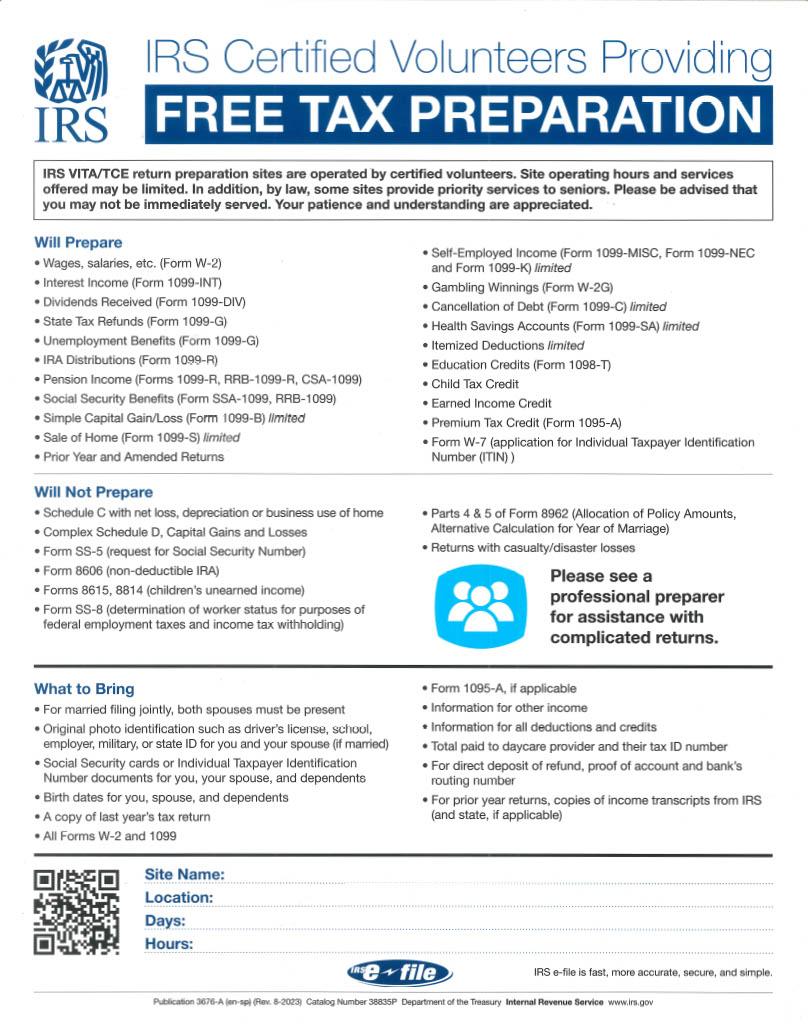

The Volunteer Income Tax Assistance (VITA) program, powered by United Way of the Lowcountry in partnership with the Internal Revenue Service (IRS), delivers FREE, confidential, and secure tax preparation and e-filing services for qualifying taxpayers.

Our team of dedicated local volunteers specializes in assisting:

- Individuals and families earning less than $75,000 annually

- Non-English speaking taxpayers

- Individuals with disabilities

- Seniors aged 60 and older

Interpreter services are available upon request to ensure everyone gets the support they need.

Start your tax season stress-free with United Way of the Lowcountry’s trusted VITA program! Visit our website to book your appointment today.

Please print and fill out F13614-C Intake/Interview and Quality Review form below (or pick up a hard copy form in advance at the site) PRIOR to coming to your appointment.

Click here for the English F13614

Click here for the Spanish F13614

What to Bring to Your Appointment

Please bring the following items to the VITA site to make it easier to prepare your return:

- Last year’s Federal Income Tax Return (2024 income tax returns)

- Social Security Cards for you, your spouse (if married), and all dependents

- Correct birth dates for all names that appear on the return

- All W-2’s for 2025, including spouses

- Form 1095-A, if applicable

- Form 1098 – Mortgage interest, property taxes

- Form 1099 – DIV, G, INT, MISC, Q, R, RRB, SSA for 2025

- Banking Information (Voided check, savings account and routing number or form from your bank) for direct deposit refunds. The IRS is phasing out refund by paper check.

- A Photo ID card (driver’s license, etc.), including spouse’s, if married and filing joint returns

- For Dependent Care Credit, bring care provider’s name, address, SSN/EIN, and amount you paid

- For Education Credit, bring 1098T or 1098E and amount paid for qualified expenses

- For Premium Tax Credit, bring 1095-A (Health Marketplace Statement)

- If you received overtime pay bring in your final paystub of 2025, and form or letter from your employer

If married and filing a joint return, both spouses must come to the VITA site.

VITA volunteers will NOT prepare Schedule D (Complex), Schedule E, Employee Business Expenses, Moving Expenses, Nondeductible IRA

Click HERE or on the image on the right to download an IRS fact sheet (English/Spanish) on what tax forms VITA will and will not prepare as well as what documents to bring with you.

VITA Volunteers Needed

The key factor for VITA’s success is its volunteers. United Way provides free training, and all VITA sites are staffed with IRS Certified VITA Volunteers to prepare tax returns in the program.

We need the support of the community in spreading the word of this free tax preparation service.

In addition to traditional face-to-face tax preparation, Lowcountry residents have the option of filing a simple return through MyFreeTaxes, a secure and free site.

Click HERE for more information.

Please click HERE if you are interested in becoming a VITA volunteer.