Volunteer Income Tax Assistance (VITA) Free Tax Preparation

Did you miss the tax deadline? The Volunteer Income Tax Assistance (VITA) Program is here to help with FREE Summer Tax Prep. Our IRS-certified volunteers can help you file your federal and state tax returns accurately and efficiently. Call 843.321.9071 or email lowcountryvitacoalition@gmail.com to reserve your IN-PERSON appointment today!

- Time & Dates: 10 AM to 2 PM (Appointment only) July 25 | August 22 | September 26

- Location: United Way of the Lowcountry Bluffton Office | 10 Buckingham Plantation Dr., Suite D, Bluffton, SC 29910

United Way of the Lowcountry partners with the Beaufort County Human Services Alliance and the Internal Revenue Service (IRS) to provide FREE, confidential, and secure preparation and e-filing of tax returns to qualified taxpayers through the Volunteer Income Tax Assistance (VITA) program.

Staffed by local volunteers, VITA prepares and files income tax returns for individuals and families with incomes under $63,398; non-English speaking taxpayers; individuals with disabilities; and persons 60 years of age and older. Interpreter services are available if needed.

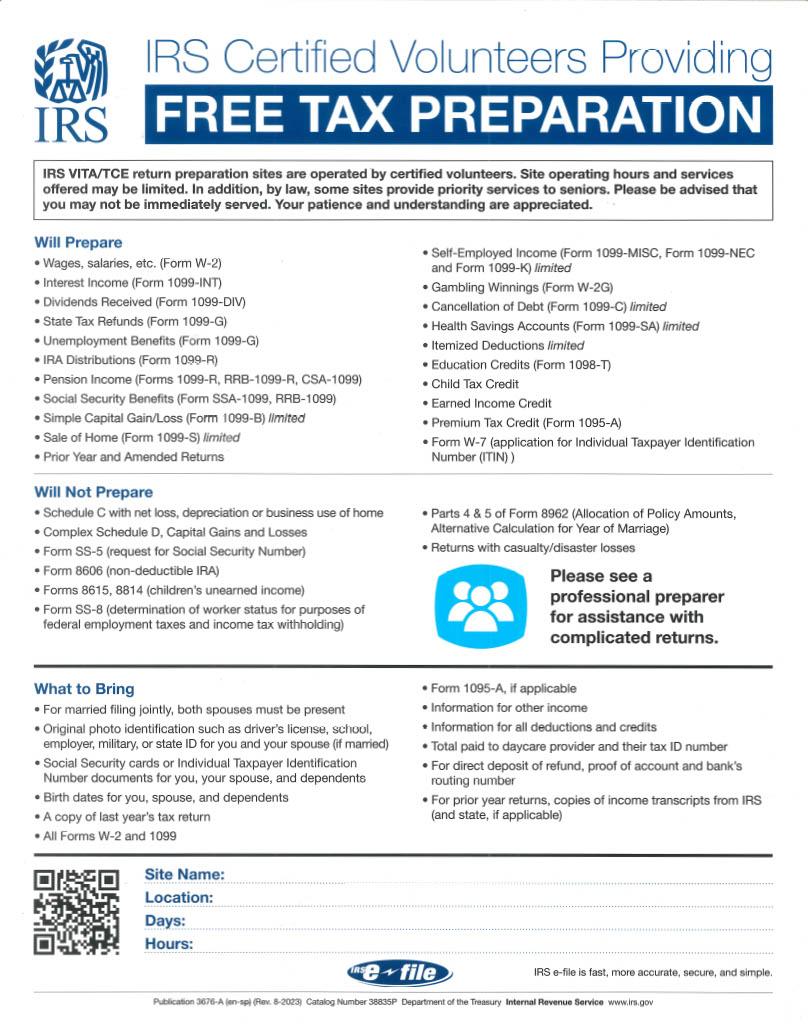

What to Bring to Your Appointment

Please bring the following items to the VITA site to make it easier to prepare your return:

- Last year’s Federal Income Tax Return (2022 income tax returns)

- Social Security Cards for you, your spouse (if married), and all dependents

- Correct birth dates for all names that appear on the return

- All W-2’s for 2023, including spouses

- Form 1095-A, if applicable

- Form 1098 – Mortgage interest, property taxes

- Form 1099 – DIV, G, INT, MISC, Q, R, RRB, SSA for 2023

- Voided check and savings account number for direct deposit of your refund (Optional, but it gets your cash to you fast)

- A Photo ID card (driver’s license, etc.), including spouse’s, if married and filing joint returns

- For Dependent Care Credit, bring care provider’s name, address, SSN/EIN, and amount you paid

- For Education Credit, bring 1098T or 1098E and amount paid for qualified expenses

- For Premium Tax Credit, bring 1095-A (Health Marketplace Statement)

If married and filing a joint return, both spouses must come to the VITA site.

VITA volunteers will NOT prepare Schedule D (Complex), Schedule E, Employee Business Expenses, Moving Expenses, Nondeductible IRA

Click HERE or on the image on the right to download an IRS fact sheet (English/Spanish) on what tax forms VITA will and will not prepare as well as what documents to bring with you.

VITA Volunteers Needed

The key factor for VITA’s success is its volunteers. United Way provides free training, and all VITA sites are staffed with IRS Certified VITA Volunteers to prepare tax returns in the program.

We need the support of the community in spreading the word of this free tax preparation service.

In addition to traditional face-to-face tax preparation, Lowcountry residents have the option of filing a simple return through MyFreeTaxes, a secure and free site.

Click HERE for more information.

Please click HERE if you are interested in becoming a VITA volunteer.