30 May VITA Tax Prep Saves Lowcountry Residents More Than $2 Million

Free VITA Tax Prep Saves Lowcountry Residents More Than $2 Million

The Volunteer Income Tax Assistance Program (VITA) has helped thousands of Lowcountry residents secure a significant financial boost and move towards greater self-sufficiency this tax season. Thanks to the program’s dedicated volunteers, a total of more than $2 million in refunds was returned to 2,185 individuals and families across the area.

“VITA goes beyond just processing tax returns,” said Dale Douthat, President and CEO of United Way of the Lowcountry (UWLC). “It’s about empowering our community. By providing free tax preparation by certified preparers, VITA ensures everyone gets the tax credits and refunds they deserve, helping them achieve greater financial mobility and build a stronger foundation for the future.”

A collaborative effort between the IRS, Beaufort County Human Services Alliance, and UWLC, VITA offers vital support to those facing financial hardship, individuals with disabilities, seniors, and those with limited English proficiency. Through free assistance with tax return filing, our VITA volunteers make sure that these residents receive the full benefits they’re entitled to.

Volunteer Power Drives Program Success

The program’s success hinges on the tireless efforts of its volunteers. An impressive 81 volunteers donated a remarkable 8,983 hours this tax season, saving eligible filers an estimated more than $500,000 in tax preparation fees. These savings directly impact the financial well-being of participating families.

“Even a few hundred dollars back can make a world of difference for those struggling financially,” Douthat added. “We’re incredibly grateful to our VITA volunteers who dedicate their time and expertise year after year. Their commitment helps Lowcountry families move towards self-sufficiency and a brighter future.”

VITA Welcomes Volunteers of All Skill Levels

The VITA program offers a variety of volunteer opportunities for individuals with and without tax expertise. Non-certified volunteers can contribute as greeters, screeners, interpreters and computer specialists. IRS-certified volunteers are needed for roles like site coordinator, tax preparer, and quality reviewer. Free IRS tax law training ensures volunteers possess the necessary skills to excel in their roles. Bilingual Spanish speakers are highly encouraged to participate.

VITA offers flexible scheduling, allowing volunteers to choose dates, times, and locations that best suit their availability. This year, volunteers assisted residents at 13 locations across the Lowcountry, including Bamberg, Barnwell, Beaufort, Colleton, and Jasper counties. VITA also expanded its reach by offering online tax filing assistance in addition to in-person support.

Join the Movement: Volunteer with VITA in 2025

To learn more about becoming a VITA volunteer for the upcoming 2025 tax season and making a positive impact in your community, please contact lowcountryvitacoalition@gmail.com or call 843.379.3064.

United Way of the Lowcountry: Building a Self-Sufficient Lowcountry

The United Way of the Lowcountry is building a brighter future for Beaufort and Jasper counties, one family at a time. We empower individuals to achieve self-sufficiency through education, resources and vital services. By investing in our community, you’re helping families thrive and building a united Lowcountry where everyone has the opportunity to succeed. Visit www.uwlowcountry.org to learn how you can invest and make a lasting difference.

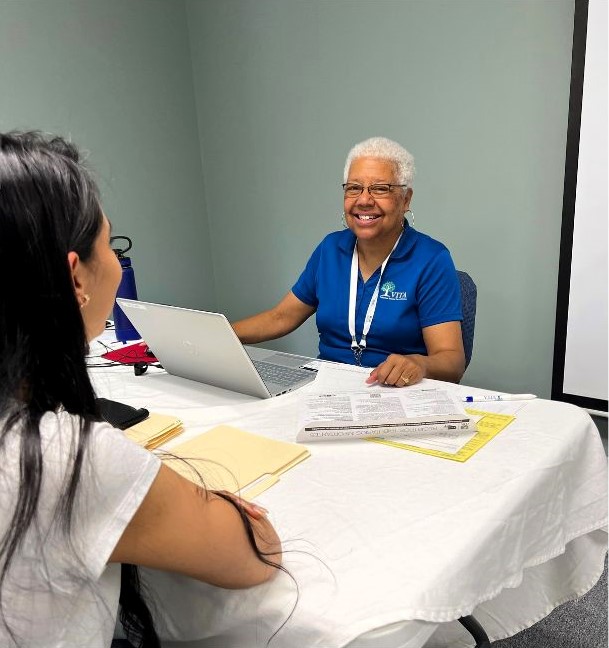

VITA Volunteer Linda Evans helps a client at Agape Family Life Center. Linda was one of 81 VITA volunteers who donated a remarkable 8,983 hours this past tax season.