31 May VITA Tax Program Helps Lowcountry Residents Receive More Than $2.6 Million in Refunds

VITA Tax Program Helps Lowcountry Residents Receive More Than $2.6 Million in Refunds

For thousands of households in the Lowcountry, accessing the right resources during tax season is critical to receiving a full tax refund. The simple truth is that when taxes are done right, the result could mean valuable tax credits and refunds that go a long way in a family’s annual budget.

Thanks to a group of dedicated volunteers at the Volunteer Income Tax Assistance Program (VITA), 1,797 Lowcountry residents received more than $2.6 million in refunds this year.

The VITA Program – a collaboration between the IRS, Beaufort County Human Services Alliance and United Way of the Lowcountry – supports individuals and families with limited means, persons with disabilities, the elderly and limited English speakers by helping accurately complete their tax returns for free.

From February through April, a team of 49 volunteers worked more than 2,700 hours, saving eligible tax filers almost $450,000 in tax preparation fees.

“When you’re walking a financial tightrope, getting a few hundred dollars back can make a big difference in preventing a financial crisis,” said Dale Douthat, President and CEO of United Way of the Lowcountry (UWLC). “We’re so thankful for our VITA volunteers who give their time and talent year-after-year to help Lowcountry families move towards financial independence and a better quality of life.”

Volunteers of all levels of experience are welcome to join the VITA Program, said Sherry Halphen, UWLC Volunteer/VITA Program Coordinator.

“Dedicated and passionate volunteers are the key to the success of VITA,” said Halphen. “VITA volunteers truly enjoy the camaraderie and tell us they look forward to returning each season.”

There are opportunities for non-tax certified and tax certified volunteers. Non-tax certified volunteers can serve as greeters and screeners; interpreters; and computer specialists/troubleshooters. Tax certified volunteers are needed as site coordinators; tax preparers; and quality reviewers. Free IRS tax law training and testing is available. There is also a special need for bilingual Spanish speakers for all positions.

Volunteers may pick the dates, times and locations most convenient for them. This year, VITA volunteers assisted residents at 10 locations throughout the Lowcountry including Bamberg, Barnwell, Beaufort, Colleton and Jasper counties.

To learn more about volunteering for the VITA Program in 2023, email lowcountryvitacoalition@gmail.com or call 843.379.3064.

About United Way of the Lowcountry

Since the 1950s, United Way of the Lowcountry has been working to create a better life for the residents of Beaufort and Jasper counties. Our focus is on protecting services vital to the immediate basic needs of the most vulnerable members of our community; while making long term investments in education, economic mobility and health, because these are the building blocks for a good quality of life. We bring together people and organizations from all across the Lowcountry who bring the passion, expertise and resources needed to get things done. Each year, United Way raises funds through our annual campaign, special events and grants. Just as funds are raised locally, United Way funds stay local. Learn how you can be a part of United Way at www.uwlowcountry.org.

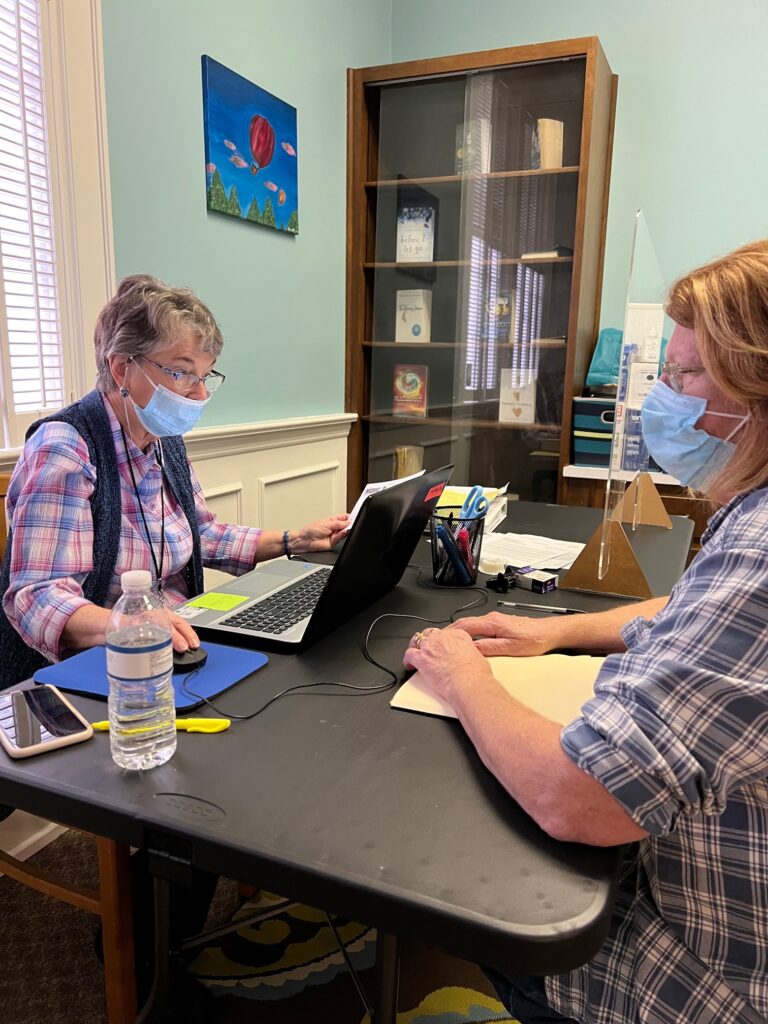

Donnita Whittier (seen here on the left) was among the 49 VITA volunteers who helped Lowcountry residents receive more than $2.6 million in tax refunds this year.